Understanding the PrimeXBT Limits: A Comprehensive Guide

In the world of cryptocurrency trading, understanding the PrimeXBT Limits PrimeXBT Limits is crucial for any trader. These limits dictate the parameters within which traders can operate, influencing their trading strategies, positions, and potential profits. In this article, we will delve deep into the various aspects of the PrimeXBT limits, exploring how they affect your trading experience and what steps you can take to optimize your trades.

What Are PrimeXBT Limits?

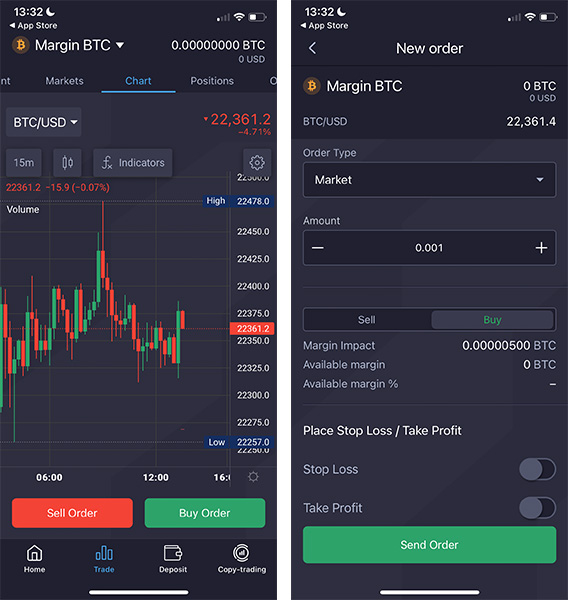

PrimeXBT is a well-known trading platform that offers leveraged trading in cryptocurrency, forex, stock indices, and commodities. However, with great potential for profit comes inherent risks, which is why the platform imposes specific limits to protect both the broker and the traders. These limits are designed to ensure that trading practices remain sustainable while minimizing the likelihood of excessive loss. Understanding these limits can be the key to developing a successful trading strategy.

Types of Limits Imposed by PrimeXBT

There are several types of limits that PrimeXBT implements, including trading limits, withdrawal limits, and leverage limits. Each plays a unique role in shaping the trading environment.

1. Trading Limits

Trading limits refer to the maximum volume of trades that can be executed within a given time frame. This includes limits on both the size of individual trades and the total exposure a trader can have across all open positions. By setting these limits, PrimeXBT aims to reduce the likelihood of market manipulation and ensure that the trading environment remains orderly and fair for all participants.

2. Withdrawal Limits

Withdrawal limits dictate how much a trader can withdraw from their account within a specific timeframe. These limits are essential for preventing fraudulent activities and ensuring that the trading platform maintains sufficient liquidity. Traders need to be mindful of these limits, especially when planning their trading strategies and managing their profits.

3. Leverage Limits

Leverage allows traders to control a larger position size with a smaller amount of capital, thereby amplifying potential profits. However, it also increases the risk of significant losses. PrimeXBT has established leverage limits based on various factors, including the type of asset being traded and market conditions. Understanding these leverage limits is vital for effective risk management.

Why Are Limits Important?

Limits are crucial in any trading environment for several reasons:

- Risk Management: Limits help traders manage risk by setting boundaries on how much they can trade or withdraw. This ensures that traders do not expose themselves to undue risk that could lead to substantial losses.

- Market Stability: By controlling the volume and exposure of trades, limits contribute to market stability. This can help prevent situations that may lead to drastic price fluctuations and instabilities

- Fraud Prevention: Withdrawal limits help mitigate the risks associated with fraud and unauthorized transactions, keeping the platform secure for all users.

How to Navigate PrimeXBT Limits

Navigating the PrimeXBT limits effectively is essential for any trader looking to maximize their trading experience. Here are several strategies to consider:

1. Understand Your Limits

The first step toward effective trading on PrimeXBT is to fully understand the limits set by the platform. Familiarize yourself with the various types of limits and how they can impact your trading strategy. This knowledge will empower you to make informed decisions when entering and exiting trades.

2. Develop a Clear Trading Strategy

With a sound understanding of the limits you face, create a trading strategy that incorporates those boundaries. Plan your positions based on your risk tolerance and the leverage you are comfortable using. This may mean scaling back on your trade sizes or managing your open positions more conservatively.

3. Monitor Market Conditions

Market conditions can change rapidly in the world of trading. Stay informed about the overall market environment, as this can impact the limits imposed by PrimeXBT. By understanding market trends, you can better gauge when to adjust your trading strategy and how to approach the limits.

4. Utilize Risk Management Techniques

Employ effective risk management techniques to minimize potential losses. Set stop-loss orders to limit your downside and ensure that you adhere to your trading limits closely. Keeping a disciplined approach to risk management can make a significant difference in your overall trading success.

5. Stay Updated with PrimeXBT Policies

Trading platforms frequently update their policies and limits based on regulatory requirements and market changes. Keep yourself informed about any changes to PrimeXBT’s policies regarding limits, as this can help you adapt your strategies accordingly.

Conclusion

Understanding the PrimeXBT limits is an essential aspect of trading on the platform. These limits play a significant role in risk management, market stability, and ensuring a secure trading environment. By familiarizing yourself with the various types of limits in place and utilizing effective strategies to navigate them, you can optimize your trading experience while minimizing risks. With a disciplined approach, you can harness the potential of PrimeXBT and engage in successful trading across various markets.